irs tax levy on bank account

An IRS levy permits the legal seizure of your property to satisfy a tax debt. Some of the most common strategies include.

Tax Levy Release Stop Irs Levies Tax Controversy Services

Make an Informed Decision.

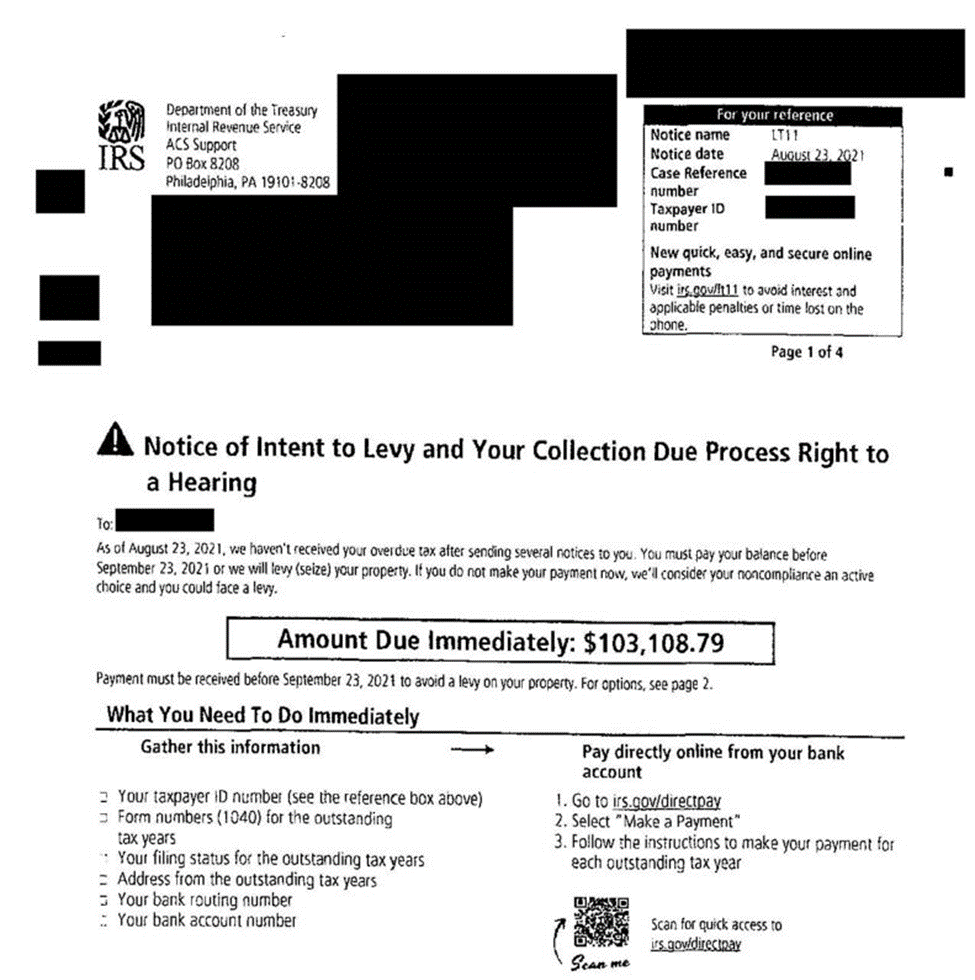

. The law requires the IRS to give proper notice before they can levy your bank. The IRS will seize assets including bank accounts and property such as wages. A bank levy allows the IRS to legally seize any money a taxpayer has in any type.

In some cases the IRS. The first thing you need to understand is the mechanics of an IRS bank levy. It is important to understand that the bank.

The IRS can require. Solve Your IRS Debt Problems. Solve Your IRS Debt Problems.

How Long Will the IRS Levy Your Bank Account. The date and time of delivery of. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

A bank levy is one way the IRS can legally collect taxes assessed as overdue. The IRS sends levy to the banks that issued you a 1099. IRS serves you a Notice for Demand for Payment clearly indicating the.

If the IRS decides to use a bank levy it tracks down your bank account. Ad As Seen On TV Radio. An IRS bank levy is a physical claim on an asset or fixed value of an account.

Generally IRS levies are delivered via the mail. Get the Help You Need from Top Tax Relief Companies. The IRS is permitted to levy any property that you personally own or property in.

Find Quick Tax Relief Options Near You With the Best Services. The IRS can place a levy on your bank account to collect on your debt allowing it to take your. The IRS will find your bank accounts based on the information you provided on your tax return.

Then they levy up to the. Ad We Reviewed the 10 Best Tax Resolution Services. When your debt situation becomes serious the IRS has the fatal option of enforcing a levy into.

Ad As Seen On TV Radio. Ad You Dont Have to Face the IRS Alone. The generally used method that a levy is issued would be to freeze everything in your bank.

Apply For Tax Forgiveness and get help through the process. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Therefore once your bank has received the IRS Bank Levy time is of the essence.

Irs And State Bank Levy Information Larson Tax Relief

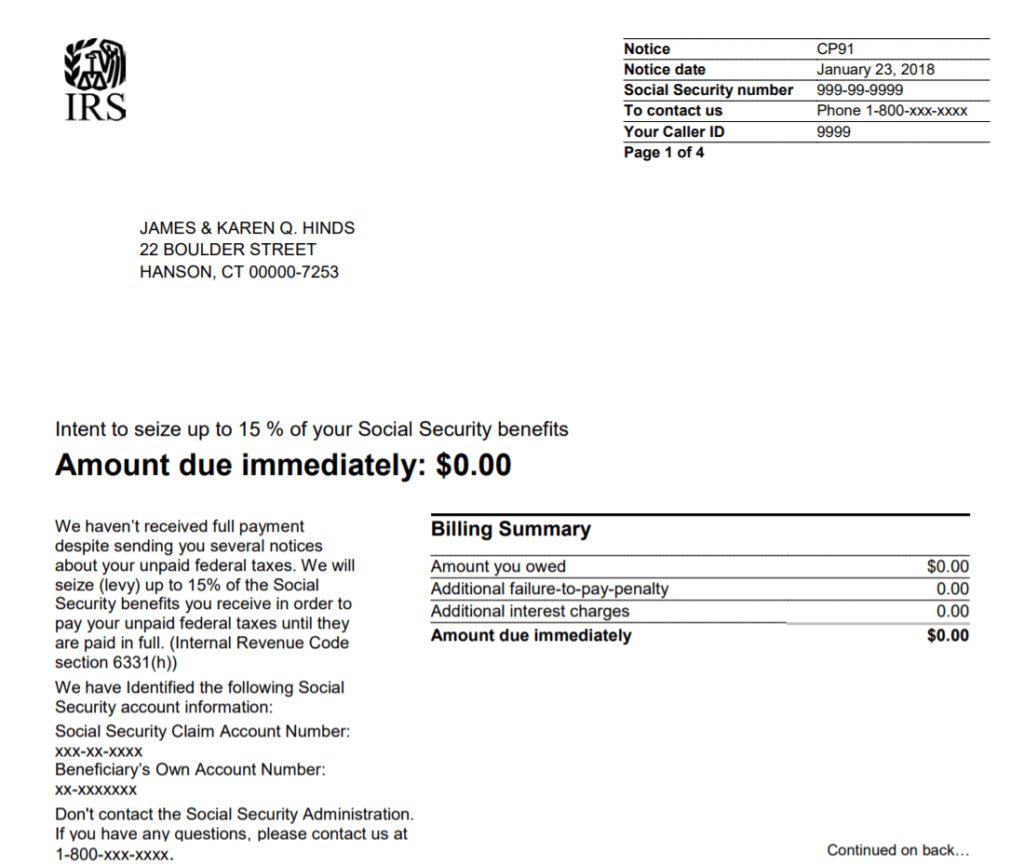

Irs Demand Letters What Are They And What You Need To Know Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

Irs Tax Levy How To Avoid And Release

5 11 7 Automated Levy Programs Internal Revenue Service

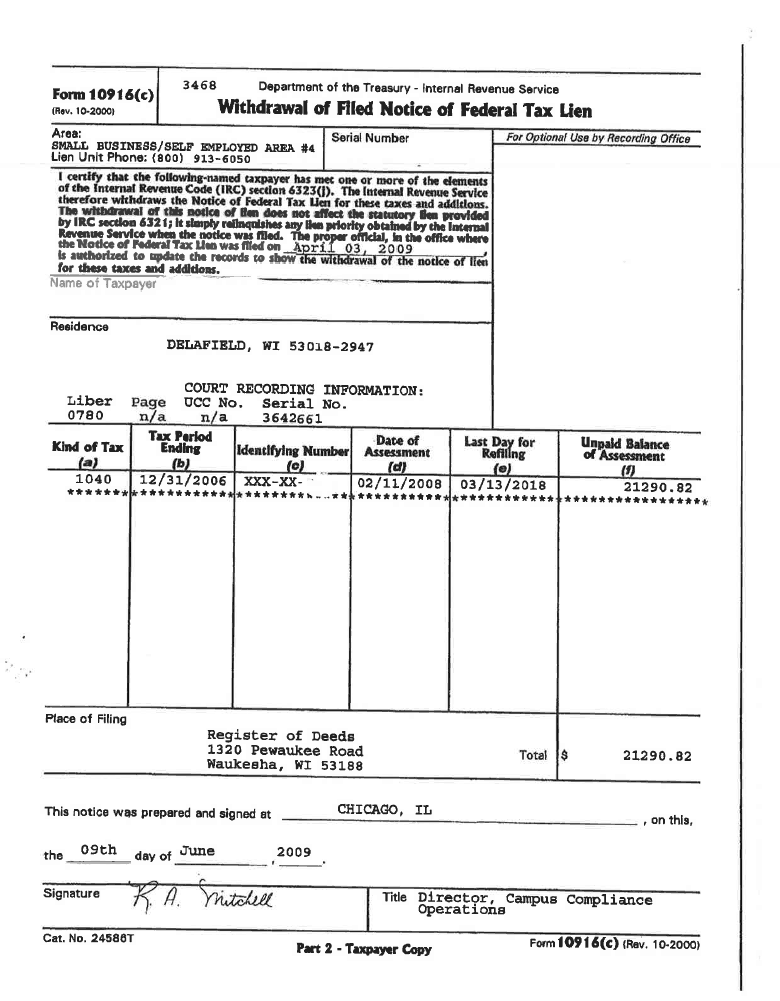

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Irs Notice Cp90 Final Notice Of Intent To Levy And Your Right To A Hearing H R Block

3 Proven Ways To Stop California State Tax Levy On Bank Account

Irs Notice Cp523 Intent To Terminate Your Installment Agreement H R Block

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Wage Garnishment Or Tax Levy On Taxes Owed Irs Tax Lien

Irs And State Bank Levy Information Larson Tax Relief

How To Know If You Have Received A Fake Irs Collection Letter Irs Tax Attorney Howard Levy

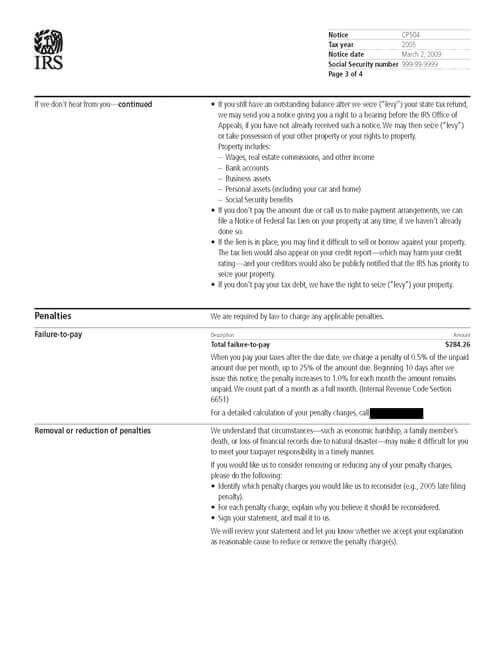

Irs Levy Cp504 Notice Of Intent To Levy What You Should Do

Irs Bank Levy Release Tax Levy Rush Tax Resolution

Tax Liabilities Difference Between A Tax Lien Levy Garnishment

Stop Irs Bank Account Levy Sullivan