does idaho have capital gains tax on real estate

250000 of capital gains on real estate if youre single. That 100000 would be subtracted from the sales price of your home this year.

Biden Plan To Exempt Farms From Elimination Of Capital Gains Tax Breaks Northern Ag Network

Does Idaho have an Inheritance Tax or an Estate Tax.

. The deduction is 60 of the capital gain net income included in federal taxable income from the. Instead of owing capital gains taxes on the 350000 profit from the sale you would owe taxes. Instead of owing capital gains taxes on the 350000 profit from the sale you would owe taxes on 250000.

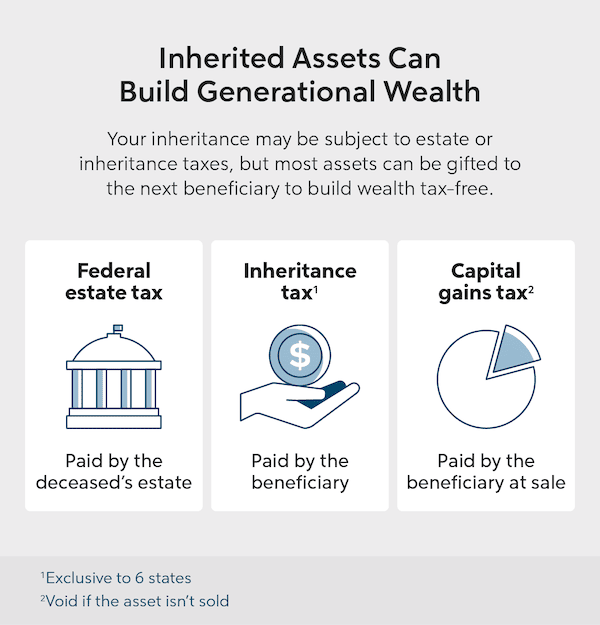

Idaho axes capital gains as income. This marginal tax rate means that. Keep in mind that if you inherit property from another state.

Without the deferral election the appreciation of 250000 from Year 1 to Year 5 is taxable in Year 5 even though you didnt truly sell the property. Many home sellers dont have to report the sale to the IRS. Its called the 2 out of 5 year rule.

500000 of capital gains on real estate if youre married and filing jointly. The taxable portion of 125000 250000. The long-term capital gains tax rates are 0 15 or 20 depending on your income.

Taxes capital gains as income and. The IRS typically allows you to exclude up to. Taxes capital gains as income and the rate reaches 575.

Your profit 50000 the difference between the two prices is your capital gain and its subject to the tax. Idaho does not levy an inheritance tax or an estate tax. Short-term capital gains are taxed as.

Does idaho have capital gains tax on real estate Monday July 25 2022 Edit Avoiding Capital Gains Tax On Real Estate How The Home Sale Exclusion Works 2021. But its important to understand the rules when it comes to reporting taxes and keeping your bill to a minimum. Heres an example of how much capital gains tax you might.

Your average tax rate is 1198 and your marginal tax rate is 22. The rate reaches 693. If you make 70000 a year living in the region of Idaho USA you will be taxed 12366.

It lets you exclude capital gains up to 250000 up to 500000 if filing jointly. You only pay the capital gains tax after you sell an asset. That 100000 would be subtracted from the sales price of your home this year.

Use Form CG to compute an individuals Idaho capital gains deduction. Short term capital gains are taxed differently. If you sell the property now for net proceeds of 350000 youll owe long-term capital gains tax on your 100000 net profit plus depreciation recapture on 90900 which is.

Capital Gains Tax Idaho Can You Avoid It Selling A Home

Capital Gains Tax Passes House Heads To Senate For Concurrence Washington State Wire

Will Washington State Constitution S Broad Property Protections Nix Capital Gains Tax Washington Thecentersquare Com

Hayden Idaho Real Estate Community Coeur D Alene Homes Real Estate For Sale Bennett Realty Group

What Is A Step Up In Basis And How Does It Work Quicken Loans

Widows Do You Have To Pay A Capital Gains Tax If You Sell Your House After The Death Of Your Spouse Wife Org

Idaho Qualified Small Business Stock Qsbs And Investor Tax Incentives Qsbs Expert

Capital Gains Tax When Selling A Home In Massachusetts Pavel Buys Houses

Capital Gains Tax Calculator 1031 Crowdfunding

Capital Gains Tax Idaho Can You Avoid It Selling A Home

2022 Capital Gains Tax Rates By State Smartasset

Real Estate Matters Rising Home Values Spur Questions About Tax Rules

Capital Gains Tax Ma Can You Avoid It Selling A Home

Idaho Estate Tax Everything You Need To Know Smartasset

How To Avoid The Idaho Gift Tax Step By Step

Gifts That Pay You Income University Of Idaho

Gubernatorial Candidate Dave Reilly From Idaho Declares He Would Abolish Property Capital Gains And Income Tax For Idahoans Who Use Bitcoin R Bitcoin